“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually and then suddenly.”

– The Sun Also Rises by Ernest Hemingway.

The Solar Death Spiral, apart from being a great name for a punk rock band, is a tale of two charts:

This trend has continued to the point where in the U.S. the average cost of energy per kilowatt-hour (kWh) from the grid is 12.2 ₵ and the average levelized cost of energy – the cost including installation, finance charges, taxes, wear & tear etc. over the expected lifetime – of residential solar is 10.5 ₵ (with tax subsides), or 13.8 ₵ (without tax subsidies). On a kWh to kWh basis, power from residential solar is already cheaper than buying it from the grid. Even excluding tax subsidies, today residential solar is only 13% higher than grid power and dropping.

Which leads to the Solar Death Spiral:

- Distributed solar becomes cheaper than grid power.

- Customers begin to leave the grid in favor of getting cheaper power from the sun.

- The costs of the grid is shared among fewer people.

- Costs for customers remaining on the grid increase, making the relative cost of solar even cheaper.

- Repeat

There is one caveat, solar only works when the sun is up.

Enter net-metering, the policy that allows residential solar customers the ability to sell unused power generated by their solar systems back to the utility and then use this credit towards buying energy at night when their system is not producing. In effect, the customer is able to use the grid as a pseudo storage system, storing up energy “credits” by selling power during the day and then claiming energy back from the grid at night. It’s a creative policy solution that encourages solar development, but contains one, potentially fatal, flaw – customers with solar systems effectively get to use the grid for free.

The actual cost of retail grid energy includes more than just the cost of the energy, it also includes the cost of power lines, substations, operations and maintenance, and government fees. In fact, the cost of the actual energy on average is less than 4 ₵. This means that if residential solar customers are given a 1:1 credit per kWh, they are effectively being paid 12.2 ₵ for a product only worth 4 ₵.

The difference is about 8 cents per kWh, the cost of which is then pushed onto the other utility customers without solar systems. As one can imagine, these 8 cents have become quite controversial:

- Distributed solar proponents argue that rooftop solar provides benefits to the grid beyond just the energy, and that net metering rates should compensate solar owners for these benefits.

- Utilities and other advocacy groups argue that net metering unfairly subsidizes distributed solar customers (often wealthy homeowners) at the cost of other utility customers (typically less wealthy customers without the capital needed to purchase a solar system or renters).

State regulators, legislators, lobbyists, and utilities have all been wrestling with the question of how to set net-metering rates. Fortunately, for the time being utilities seem to have found ways to stave off the death spiral through new, innovative rate structures.

This success however, is likely fleeting.

Today, the cost of residential battery storage is still much higher than the cost of using the grid, but some analysts are predicting that balance could change in as early as 10 years. In a world where solar and battery costs keep decreasing while grid costs are at best, staying level, it is easy to see how defecting from the grid could soon become cheaper than continuing to use power from the utility.

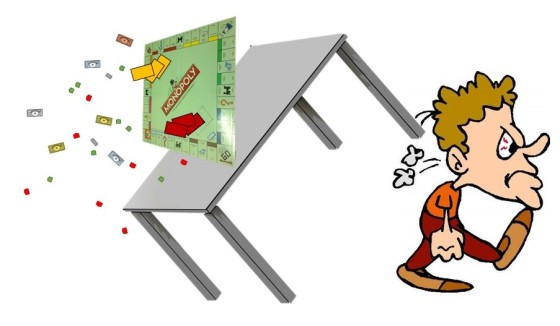

So what then, should utilities just take their monopoly game and go home?

No, the answer is of course Collaborative Innovation.

Let’s start with Contradictive Thinking, what is the contradiction?

Should regulators encourage development of distributed renewable energy or protect electric utilities from the solar death spiral?

Change it to:

Should How can regulators encourage development of distributed renewable energy or and protect electric utilities from the solar death spiral?

Now some Divergent Thinking:

- Can the utility model be revamped from a capital investment-return structure to a more performance-based model where the utility is rewarded for providing diverse distributed reliable energy services customers want?

- In the face of new competitive alternatives, can utility regulations be relaxed to allow utilities to enter some risk to innovate?

- Can we create a collaborative task force including a broad representation of customers, regulators, utilities, linemen, businesses, etc. to map out the utility regulatory system and offer potential alternatives?

Minnesota is attempting this now with the e21 initiative, a collaborative effort to develop a regulatory framework for more nimble and responsive utilities.

Maybe some Lateral Thinking, for good measure:

- How have regulated telecommunication companies dealt with the un-bundling of their services? The transition from vertically integrated cable companies to internet service providers (where content is now shipped between customers) is like the current transition in energy. What lessons can be taken from this industry and ported over to energy utilities?

- Are there other adjacent services that utilities can offer beyond the quickly eroding monopoly on lowest priced power? DC Microgrids? Establishing distributed energy markets? Creation of an internet of energy?

Some of these ideas will be investigated in future blog posts, but for now it is important to realize that energy utilities cannot just sit and wait for their business to die. There is a negotiated solution that can be mutually beneficial to customers and utilities, and it is going to take the model of Collaborative Innovation to get there.

If you liked what you read please click “follow” blog in the right column or follow me on twitter @CDBNV.